Definition Of Risk Hedge

Although the textbook definition of hedging is an investment taken out to limit the risk of another investment insurance is an example of a real world hedge.

Definition of risk hedge. A hedge is a type of investment that is intended to reduce the risk of adverse price movements in an asset. An investor can hedge the risk of one investment by taking an offsetting position in another investment. This means that one will profit or at least avoid a loss no matter which direction the security s price takes. When a company buys the insurance it pays a premium to shift the risks to the insurance company.

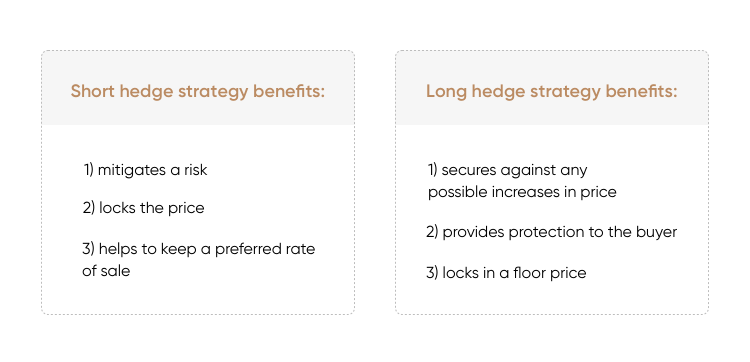

Many companies buy insurance to hedge against the different kinds of risks such as the risk of property damage risk of fire risk of plant destruction the risk of liabilities etc. A line of bushes or small trees planted very close together especially along the edge of a. A hedge can be constructed from many types of financial instruments including stocks exchange traded funds insurance forward contracts swaps options gambles many types of over the counter and derivative products and futures contracts. The values of the offsetting investments should be inversely correlated.

Global growth and risk concerns appear to have investors recognising gold s use as a risk hedge. Hedging risk hedging risk definition. 1 19 how are futures used to hedge a. The risk has been lowered a bit now that the dodd frank wall street reform act regulates many hedge funds and their risky derivatives.

Investors return to gold scheduled guest speakers include globally famous economists and risk hedge experts to discuss the role of precious metal investing in the current unsettled global macro economic environment. Government backed by its ability to tax incur debt and print more money. Hedging is a strategy for reducing exposure to investment risk. A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment.

Normally a hedge consists of taking an offsetting position in a related security. There are a large number of hedging strategies that one can use. To reduce the risk of an investment by making an offsetting investment.

%20(002).png)