Definition Of Risk Neutral Probability

This may sound crazy because.

Definition of risk neutral probability. Risk neutral is a concept used in both game theory studies and in finance. The benefit of this risk neutral pricing approach is that. Provides a positive profit with a positive probability and understanding risk neutral. That is we can create a new set up probabilities by adjusting the probability of good market outcomes downward and increasing the probability of bad market outcomes.

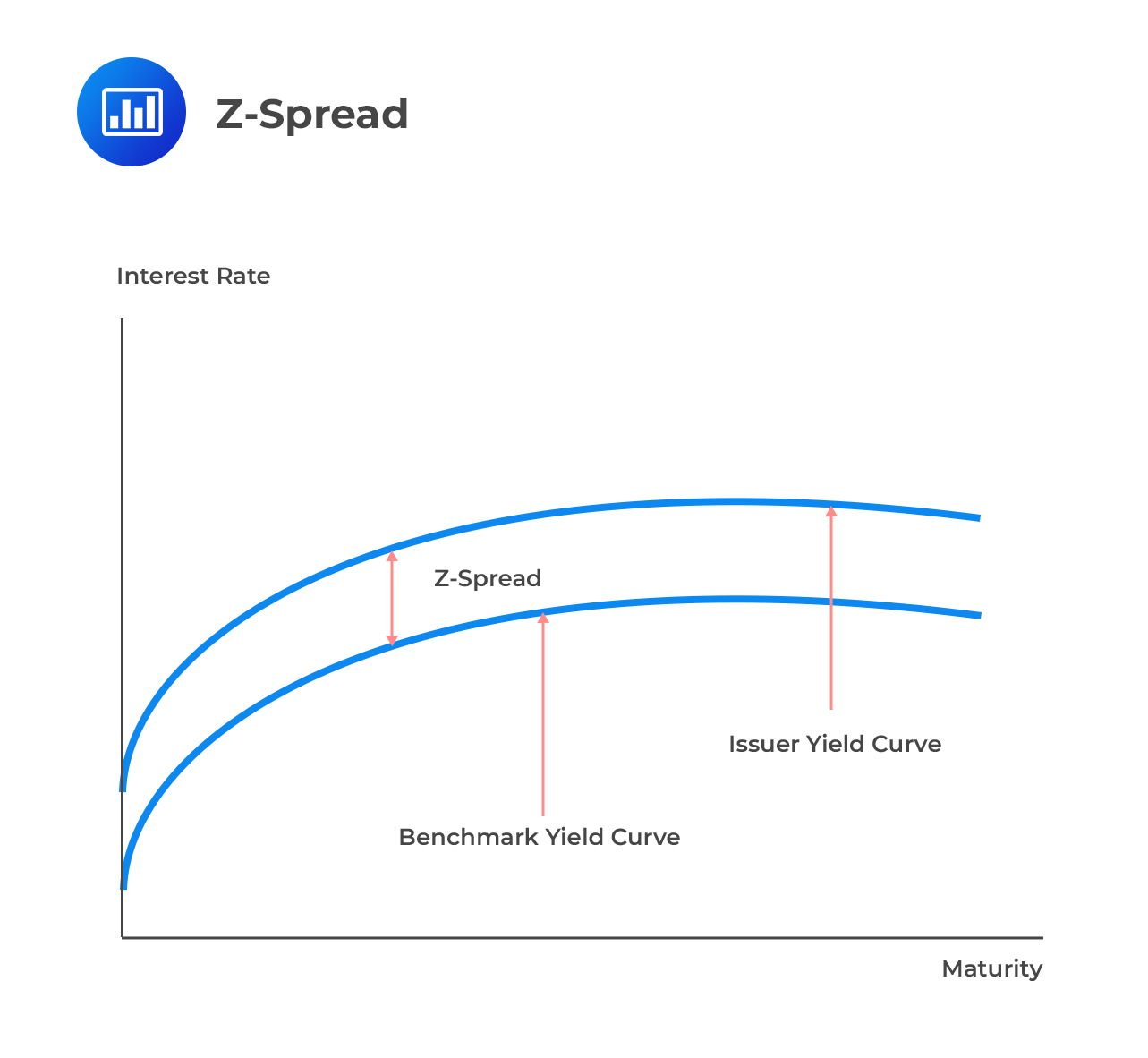

In the context of assets or financial instruments risk neutral probabilities are the. It refers to a mindset where an individual is indifferent to risk when making an investment decision. What is risk neutral. Risk neutral probabilities are probabilities of future outcomes adjusted for risk which are then used to compute expected asset values.

A risk probability is the chance that a risk will occur. In mathematical finance a risk neutral measure also called an equilibrium measure or equivalent martingale measure is a probability measure such that each share price is exactly equal to the discounted expectation of the share price under this measure this is heavily used in the pricing of financial derivatives due to the fundamental theorem of asset pricing which implies that in a. A requires no invested capital b provides a positive profit with 100 probability or slightly more generally a requires no invested capital b. As such risks are modeled with probabilities and impacts the following are common ways to model risk probability.

Note that 2 22 is valid for any choice of a risk neutral probability measure q in. By definition a risk is a probability of a loss. The curvature of the utility function of the three investors in this chart tells us whether they are risk averse neutral or seeking risk takers. Finance theory has shown that instead of computing values this way we can embed risk compensation into our probabilities.

The risk neutral investor is simply not interest in risk at all risk does not enter his or her cognitive radar he or she is indifferent regardless of whether it is high or low risk. A crucial difference between the two state single period model and a general single period market model is that in the latter model a replicating strategy might not exist for some contingent claims.