Definition Of Risk Weighted Assets Basel Iii

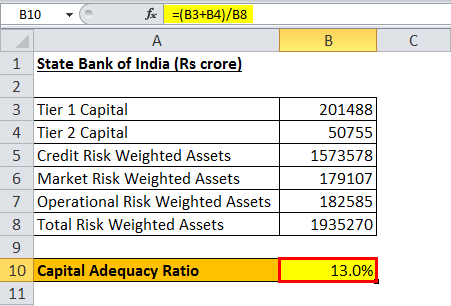

This sort of asset calculation is used in determining the capital requirement or capital adequacy ratio car for a financial institution.

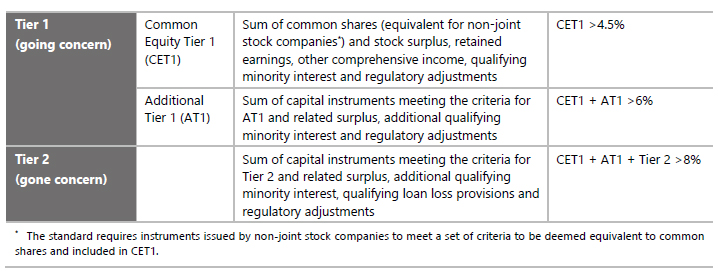

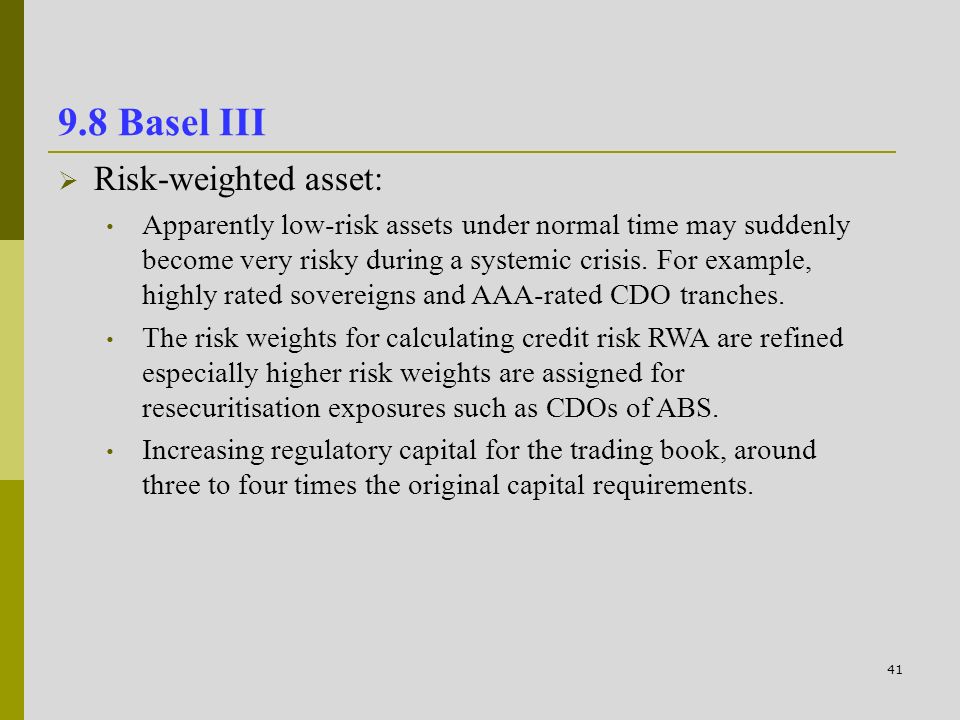

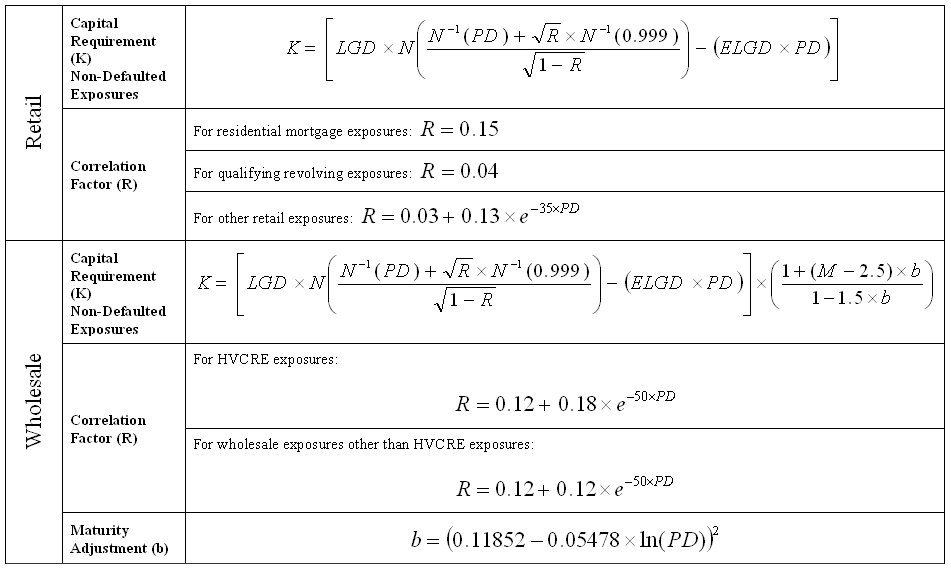

Definition of risk weighted assets basel iii. As per the basel committee on banking. Ensures that banks and financial institutions have a minimum capital maintained to be safe during times of uncertainty. The risk weighted asset can be calculated as below. Risk weighted asset also referred to as rwa is a bank s assets or off balance sheet exposures weighted according to risk.

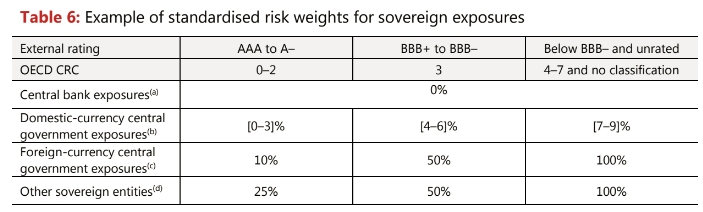

Basel iii a set of international banking regulations sets the guidelines around risk weighted assets. Maintaining a minimum amount of capital helps to mitigate the risks. Risk weighted assets is a banking term that refers to an asset classification system that is used to determine the minimum capital that banks should keep as a reserve to reduce the risk of insolvency. In the basel i accord published by the basel committee on banking supervision the committee explains why using a risk weight.

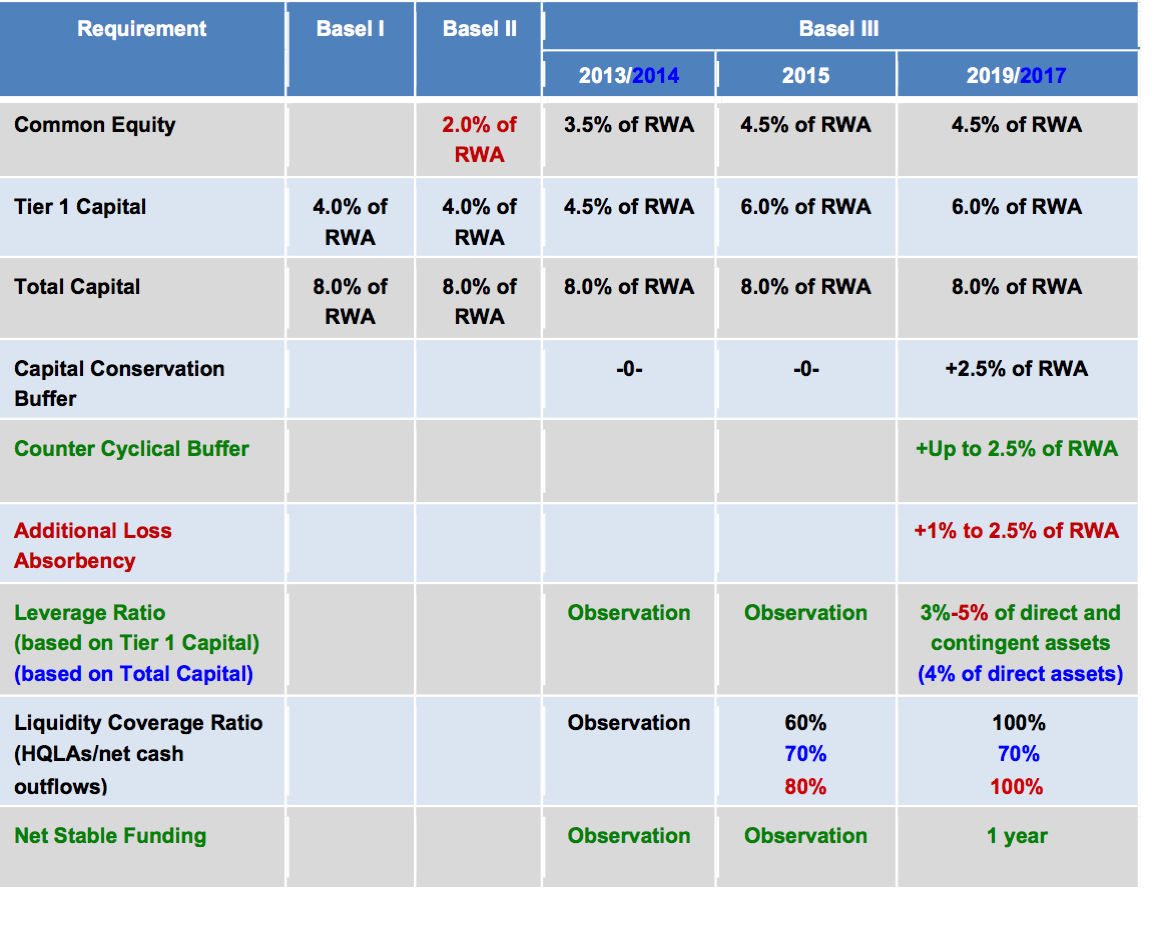

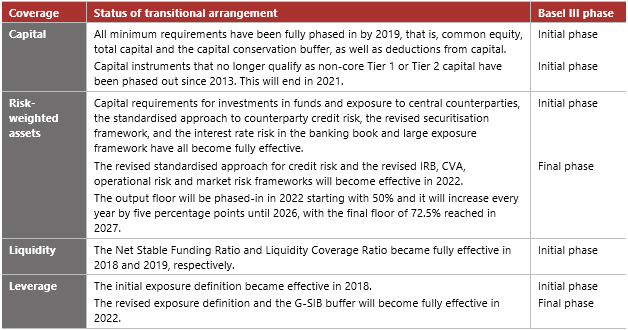

Basel iii increased common equity tier 1 capital from 4 to 4 5 of risk weighted assets rwas and minimum tier 1 capital from 4 to 6 compared to basel ii.