Definition Of Risk Weighted Assets

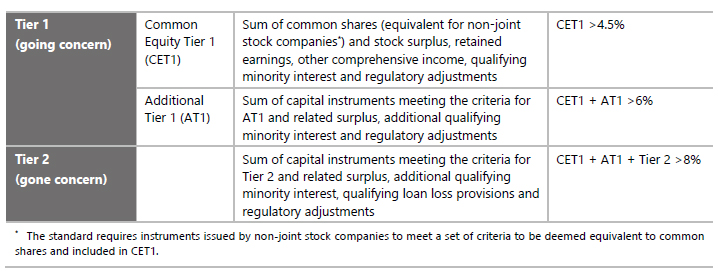

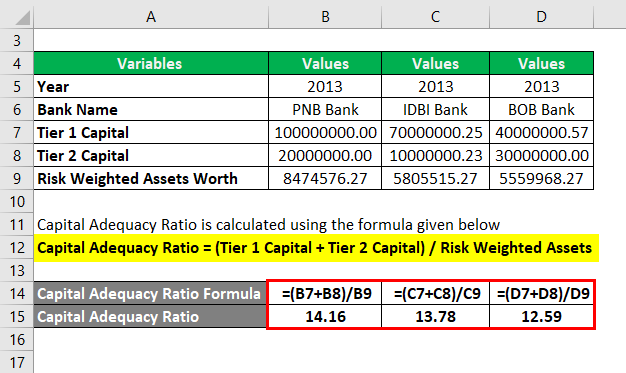

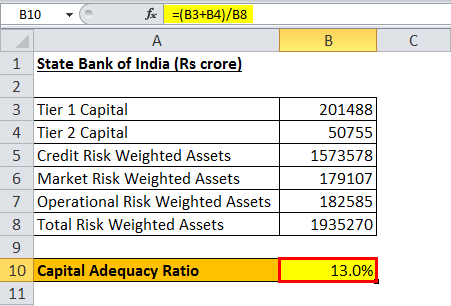

This sort of asset calculation is used in determining the capital requirement or capital adequacy ratio car for a financial institution.

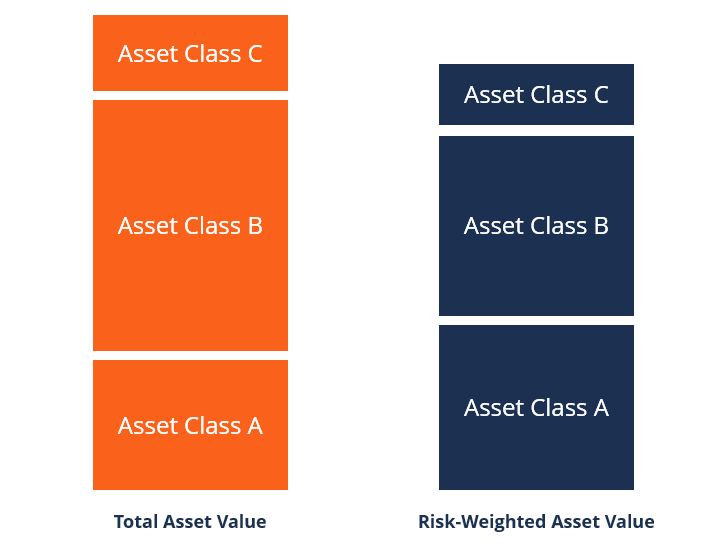

Definition of risk weighted assets. In simpler terms risk weighted assets are such assets like cash investment loans etc. Government bonds have a risk weight of 0 while all other assets have a risk weight of 100. Risk weighted asset enables a comparison between two different banks operating in two different regions or countries. One calculates the units of each type of asset a bank carries to find how risky its assets are.

Risk weighted assets is a banking term that refers to an asset classification system that is used to determine the minimum capital that banks should keep as a reserve to reduce the risk of insolvency. Risk weighted assets are used to determine the minimum amount of regulatory capital that must be held by banks to maintain their solvency. Maintaining a minimum amount of capital helps to mitigate the risks. Some assets such as debentures are assigned a higher risk than others such as cash.

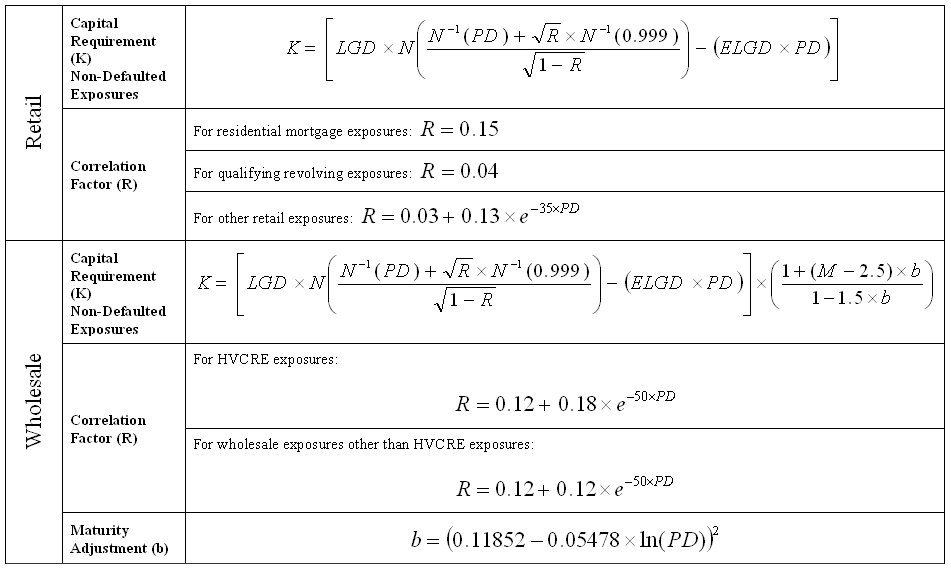

This minimum is based on a risk assessment for each type of bank risk exposure. However value of each asset is assigned with a weighted risk like 100 risk weight for corporate loans and 0 risk for government bonds. A high risk weighted asset means the assets held are risky and would require a higher capital to be maintained. The reserve requirements for a bank weighted according to risk risk weighted assets are the capital a bank must keep to cover its liabilities.

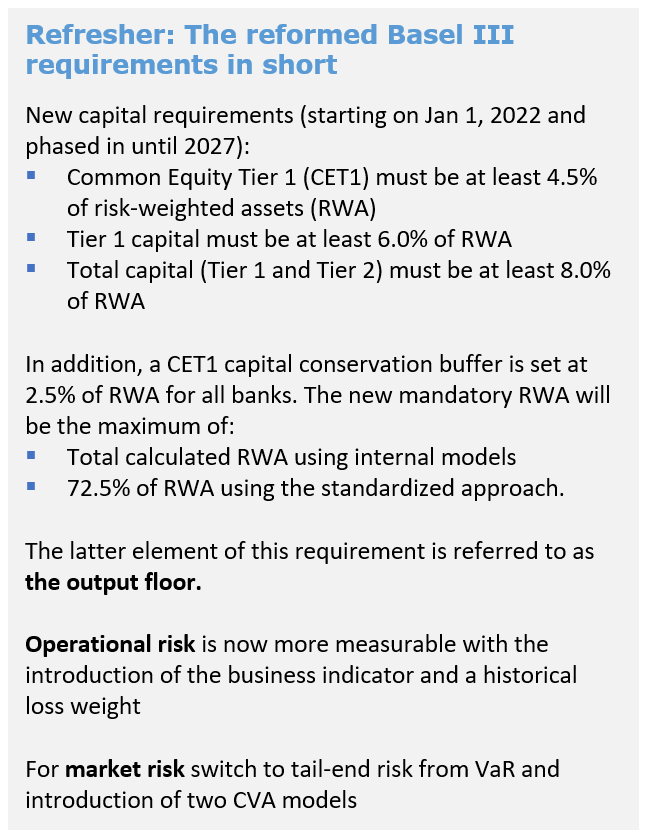

In the basel i accord published by the basel committee on banking supervision the committee explains why using a risk weight. Comprising total assets owned by the banks. A low risk weighted asset means the assets held are less risky and would require lower capital to be maintained. Credit market operational counterparty and credit valuation adjustment risks.

They are calculated as follows. A bank s assets weighted according to credit risk. Risk weighted assets means as of any quarterly financial period end date or extraordinary calculation date as the case may be the aggregate amount expressed in pounds sterling of the risk weighted assets of the group as of such date as calculated by the company on a consolidated basis in accordance with the capital regulations applicable to the group on such date which calculation shall. The riskier the asset the higher the rwas and the greater the amount of regulatory capital.