Definition Qualified Business Income

Business income is any income realized as a result of business activity.

Definition qualified business income. Fs 2019 8 april 2019 many individuals including owners of businesses operated through sole proprietorships partnerships s corporations trusts and estates may be eligible for a qualified business income deduction also called the section 199a deduction. Business income is a type of earned income and is classified as ordinary income for tax purposes. The final regulations provided clarity on many issues related to this deduction that was unclear in the august 2018 proposed regulations. Some trusts and estates may also claim the deduction directly.

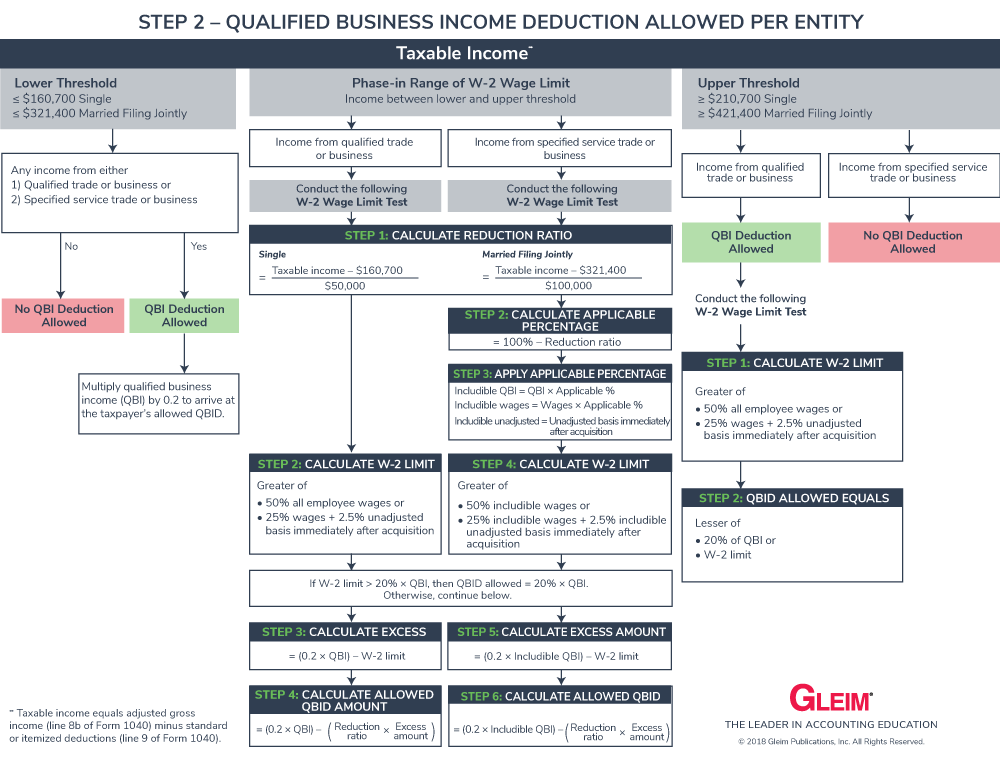

The qualified business income deduction also called the qbi deduction pass through deduction or section 199a deduction was created by the 2017 tax cuts and jobs act tcja and is in effect for tax years 2018 through 2025. 199a deduction commonly known as the qualified business income qbi deduction provides a 20 percent deduction for owners of pass through entities with limitations. Such term shall not include any qualified reit dividends or qualified publicly traded partnership income. The term qualified business income means for any taxable year the net amount of qualified items of income gain deduction and loss with respect to any qualified trade or business of the taxpayer.

Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. The qualified business income qbi deduction is a tax deduction for pass through entities. For purposes of this section the term qualified business income or qbi means for any taxable year the net amount of qualified items of income gain deduction and loss with respect to any trade or business of the taxpayer as described in paragraph b 2 of this section provided the other requirements of this section and section 199a are. Learn if your business qualifies for the qbi deduction of up to 20.

:max_bytes(150000):strip_icc()/Target1-de0fcdc67fc44470805a5ccdf3b105e0.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Investment_Income_Apr_2020-01-fae8874a0f0c4ab38e8e3cc18801e803.jpg)