Definition Of Like Kind In A 1031 Exchange

Any combination works and provides exchangors with great flexibility.

Definition of like kind in a 1031 exchange. Section 1031 defines like kind as real estate that is held for productive use in a trade or business or for investment purposes. The definition of like kind property in a 1031 exchange real estate investors who sell a property can sometimes take advantage of a section in the u s. Under the tax cuts and jobs act section 1031 now applies only to exchanges of real property and not to exchanges of personal or intangible property. This means both properties.

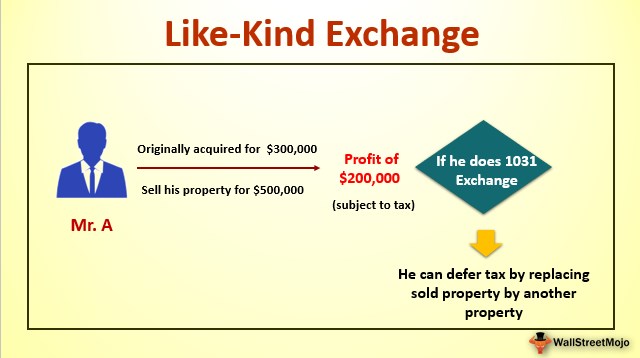

Any type of investment property can be exchanged for another type or like kind investment property. This is called a 1031 exchange after the section of tax code that offers this benefit. Although most swaps are taxable as sales if yours meets the. 1031 exchange has become an issue.

Irs proposed new regulations for like kind exchanges under section 1031. Irs tax code that allows them to defer capital gains or losses on the property. Because of the change under the tcja the effect of the receipt of personal property incidental to the taxpayer s replacement real property in an intended sec. This property can be both a business or a real estate investment.

Like kind refers to the nature of the investment. Broadly stated a 1031 exchange also called a like kind exchange or a starker is a swap of one investment property for another. A like kind exchange sometimes styled as a like kind exchange is a tax deferred transaction that allows for the disposal of an asset and the acquisition of another similar asset without. Generally if you make a like kind exchange you are not required to recognize a gain or loss under internal revenue code section 1031.

Investors can sell a property and reinvest their capital gains in a similar property known as a like kind property of equal or greater value avoiding capital gains taxes and other taxes. The guidance provides the definition of real property and treatment of incidental personal property in the section 1031 context. 1031 exchange gain or loss may be recognized if money or property is received that is not of like kind to the relinquished property. On june 11 2020 the irs released proposed regulations for like kind exchanges under internal revenue code the code section 1031 to.

For example a single family rental can be exchanged for a duplex raw land for a shopping center an office for apartments. If as part of the exchange you also receive other not like kind property or money you must recognize a gain to the extent of the other property and money received. Section 1031 defers tax when this real estate is exchanged in a.